Texas Does Not Have a State Income Tax

Instead, property taxes in Texas support local governments to fund schools, roads, public safety, and other essential services. These taxes are typically based on the value of your real estate and are applied according to your property’s location.

Every spring the County Assessor sends homeowners a notice declaring the assessed value of their property. This assessment determines how much you’ll pay in property taxes to supports your community’s needs.

Property Taxes Trend Upward With Home Values

Property taxes in Texas have increased in recent years due to the rapid escalation in home values. Of course you want the value of your home to go up, but receiving that notice can be quite a shock.

If your mortgage includes an escrow account, your monthly payment may change in order to have enough money in the account to pay your property taxes and homeowners insurance when the time comes.

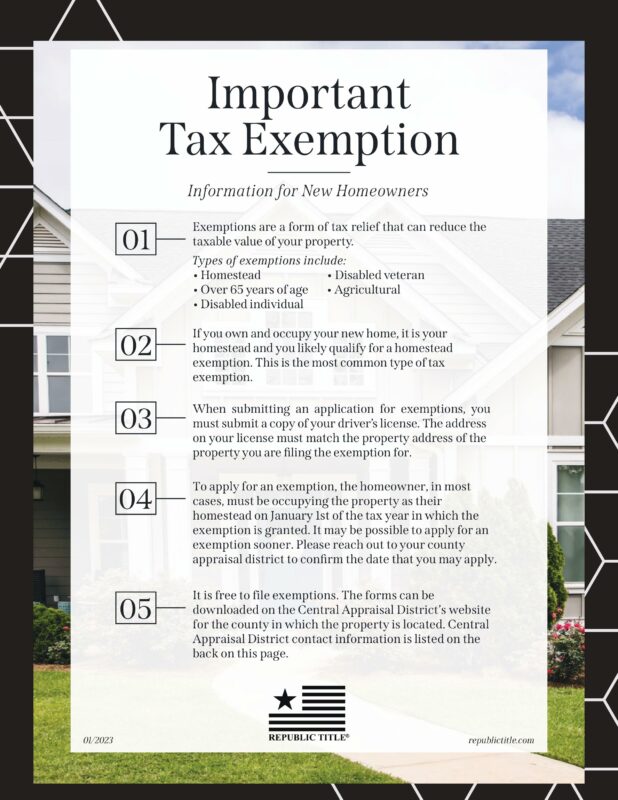

In order to reduce the dollar amount you pay, you can file for certain tax exemptions—homestead being a big one if you own your home and claim it as your primary residence. Additionally, you may qualify for other exemptions such as over 65 years of age, disabled individuals, disabled veterans, and agricultural.

If you think your assessment is out of line, contact your County Appraisal District.

Don’t confuse your property assessment with a property appraisal. An appraisal is done by a licensed professional appraiser who issues a written opinion of value. More info from NAR.

Do Property Taxes make you want to hide?

- Are you worried about the accuracy of your property tax assessment? Give me a call and I’ll do a market analysis of your home – fast, free & easy!

- And…don’t forget to file Homestead Exemptions with your county. You only have to file one time and it’s FREE! Could not be easier!

Call Marian Porter, Broker Associate – 214-577-7766

Important Tax Exemption Information for Homeowners

Read more about Taxes in Texas – Property Tax in Texas

Collin County Central Appraisal District

collincad.org | 469-742-9200

Dallas County Central Appraisal District

dallascad.org | 214-631-0520

Denton County Central Appraisal District

dentoncad.org | 940-349-3800

Ellis County Central Appraisal District

elliscad.org | 972-937-3552

Grayson County Central Appraisal District

graysonappraisal.org | 903-893-9673

Hunt County Central Appraisal District

hunt-cad.org | 903-454-3510

Johnson County Central Appraisal District

johnsoncad.com | 817-648-3000

Kaufman County Central Appraisal District

kaufman-cad.org | 972-932-6081

Parker County Central Appraisal District

parkercad.org | 817-596-0077

Rockwall County Central Appraisal District

rockwallcad.com | 972-771-2034

Tarrant County Central Appraisal District

tad.org | 817-284-0024